As the Pakistan Super League (PSL) completes its tenth season, Pakistan Cricket Board (PCB) has begun a formal valuation process of all six franchises. The move marks a key step in reshaping the league’s commercial structure and could pave the way for expansion in the coming years.

The league was launched in 2016, with its first editions staged in the UAE. Within four years, the PSL had made a full transition to Pakistan, with all matches being played in the country from 2018 onwards. The shift significantly boosted local engagement and helped establish the PSL as the country’s leading T20 competition.

Over the past decade, PCB has earned a total of USD 142.3 million in franchise rights fees. Among the original five teams, Karachi Kings pay the highest annual fee at USD 2.6 million, followed by Lahore Qalandars (USD 2.5 million), Peshawar Zalmi (USD 1.6 million), Islamabad United (USD 1.5 million), and Quetta Gladiators (USD 1.1 million). These figures reflect the initial valuations set in 2016, though the league’s growth in popularity and commercial reach now necessitates a market-aligned model.

Multan Sultans were added in the third season, when the Dubai-based Schön Group secured the franchise at USD 5.2 million per year. That ownership was short-lived, with the PCB terminating the eight-year agreement after one season due to payment defaults. The franchise was re-tendered and awarded to the Tareen family, whose USD 6.3 million bid remains the highest for any PSL team to date.

In total, Multan have paid USD 49.3 million in franchise fees over eight seasons, with the Tareens accounting for USD 44.1 million since taking over in 2019.

Over the years, PSL franchises have repeatedly raised concerns over what they termed an imbalanced financial model that disproportionately benefited the PCB while limiting franchise growth. Tensions peaked in 2021 when all six franchises collectively took legal action against the PCB, challenging what they viewed as a one-sided revenue structure.

The franchises argued that despite their increasing investments and operational costs, the league's existing financial framework heavily favored the board, offering limited returns to the team owners. The standoff eventually led to negotiations and that led Ehsan Mani, the previous board chairman, to set up a one-man panel with a retired chief justice of the Supreme Court of Pakistan Tassaduq Hussain Jillani to arbitrate on the issue.

The assessment and one man working group formed a report as a result PCB agreed to introduce a revised financial model aimed at providing more equitable revenue sharing, helping ease relations between both sides and setting the stage for long-term stability.

All franchises had in result got 95% of revenue generated from all revenue streams including broadcasting rights, sponsorship rights and gate receipts from the seventh edition onward. For PSL 5 and 6, the PCB had agreed to share 98% of the central pool revenue as an additional relief in view of the Covid-19 pandemic that disrupted both seasons. In previous years, the revenue shared varied between 85% and 90%.

The ongoing valuation exercise led by an independent firm will establish updated values for the existing franchises and set a base price for a potential seventh and eighth team. Under the contractual framework, each existing franchise will now be required to pay an increased annual fee. As per the contract terms, the yearly rights fee will be increased by either 25% of the franchise's current fee or 25% of its new market valuation, whichever amount is higher.

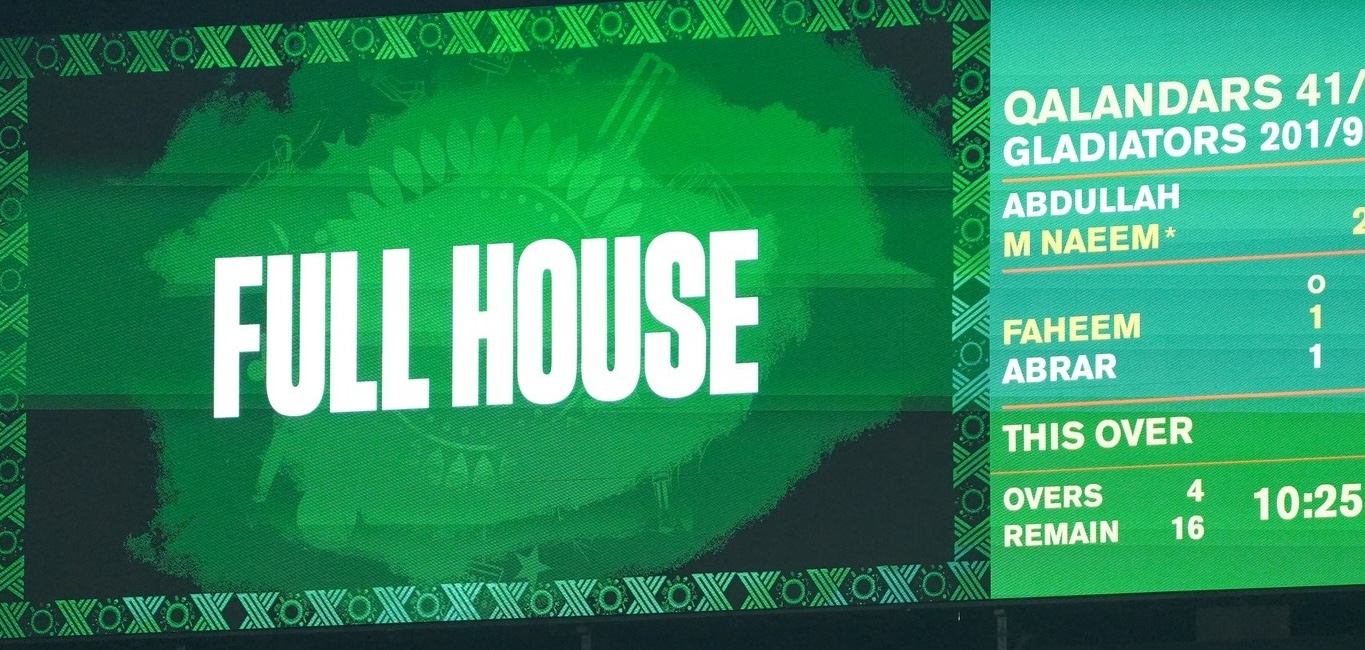

With rising broadcast revenue, increasing sponsorship deals, packed stadiums, and growing overseas interest, PSL has emerged as one of the most commercially viable leagues outside India. The financial overhaul is expected to introduce more transparency, align franchise contributions with market realities, and set up the league for sustainable long-term growth.